The Consumer Financial Protection Bureau (CFPB) has finalized a new rule that will cap credit card late fees at $8, in a move that is estimated to save American families more than $10 billion annually.

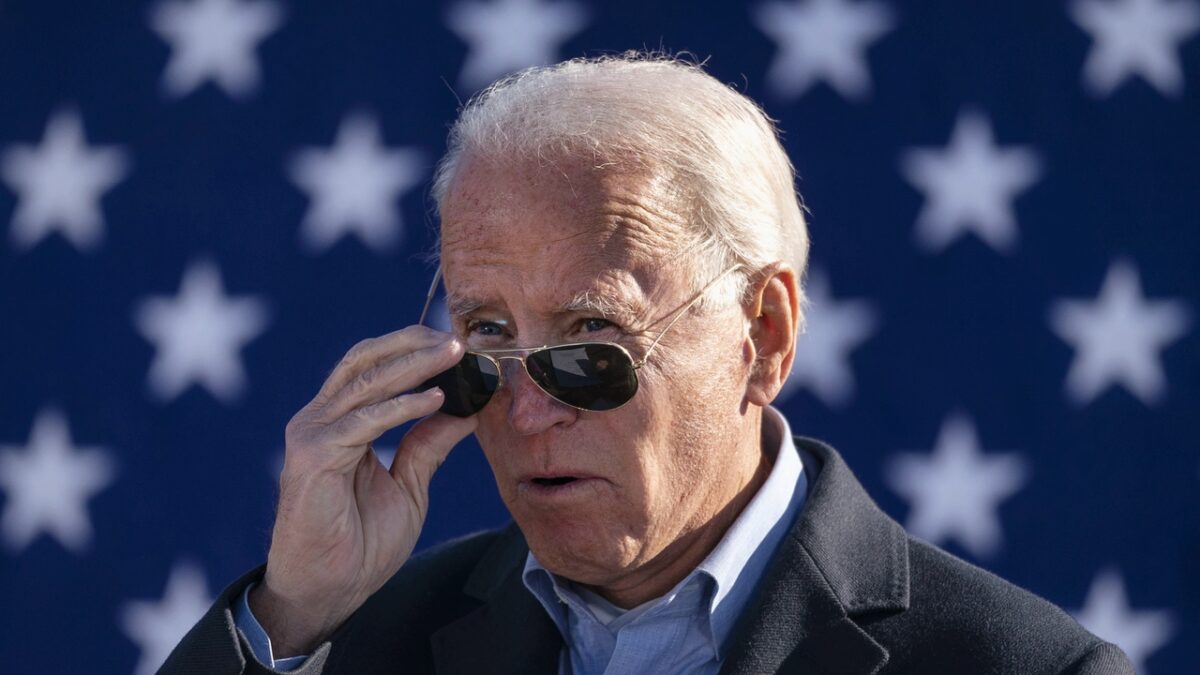

The rule will apply to the country's largest credit card issuers, covering those with more than 1 million open accounts. This regulation is part of a broader initiative by the Biden administration to crack down on "junk fees," which are hidden surcharges that consumers pay on various financial products and services.

While this new rule is being lauded as a win for consumers, banking and credit card companies have started to react, expressing concerns about how it will impact the industry and consumers. American Bankers Association President and CEO Rob Nichols argues that the rule will not only reduce competition and increase the cost of credit, but also lead to more late payments, higher debt, lower credit scores, and reduced credit access for those who need it most. He further states that the rule should not be allowed to go into effect.

Senator Tim Scott, R-S.C., has also announced plans to fight the implementation of the new rule, citing potential negative consequences for consumers. He argues that the reduction in the cap on late penalties may decrease the availability of credit card products for those who need it most, and increase rates for borrowers who pay on time. The senator plans to use the Congressional Review Act process to oppose the implementation of the rule.

While lowering the cap on late penalties may sound like a good talking point, in reality it will:

❌ decrease the availability of credit card products for those who need it most

❌ raise rates for many borrowers

❌ increase the likelihood of late payments

— U.S. Senate Banking Committee GOP (@BankingGOP) March 5, 2024

The Consumer Bankers Association (CBA), which represents the country's largest retail banks, including Bank of America, Capital One, Citigroup, Wells Fargo, and JPMorgan Chase, also criticized the new rule. CBA President and CEO Lindsey Johnson argues that the policy goals of the rule are not necessarily consumer protection, but consumer redistribution. She also expresses concern about the CFPB's rushed decision-making process, which may endanger consumers' long-term financial health.

Supporters of the new rule argue that it will benefit the majority of consumers who pay their credit card bills on time, as it will offset the costs of late payments by a small minority of frequent late-payers. They also believe that this rule will promote financial discipline and responsibility by discouraging late payments with high fees. The CFPB estimates that this new regulation will save the average consumer roughly $220 per year.

Opponents of the rule argue that it will ultimately hurt consumers by reducing competition, increasing the cost of credit, and potentially causing more late payments. They also express concern that the CFPB is using misleading statements and data to make the case for the rule and that it may negatively impact consumers' access to credit. They believe that lawful and contractually agreed-upon payment incentives promote responsible financial behavior and protect consumers' access to credit.

It remains to be seen how this new rule will impact the credit card industry and consumers. While the Biden administration and supporters of the rule argue that it will protect consumers from excessive late fees, opponents believe that it will have the opposite effect, ultimately hurting those who rely on credit the most.

As the rule goes into effect, it is likely that there will be continued debate and discussion about its impact on the industry and consumers.